HEADLINES

- Continuing operations (new Tate & Lyle) delivered +18% revenue and +14% profit1 growth

- Significant acceleration in innovation with +35% New Product revenue growth

- Effective management of cost inflation through pricing, productivity and cost discipline

- Major strategic divestment re-positions Tate & Lyle as growth-focused food & beverage solutions business

- Acquisition of leading dietary fibre business in China significantly strengthens fortification platform

- Double-digit reduction in GHG emissions in last two years2 and new carbon net zero commitment by 2050

- Strong balance sheet enables investment for growth and payment of £500m special dividend in May 2022

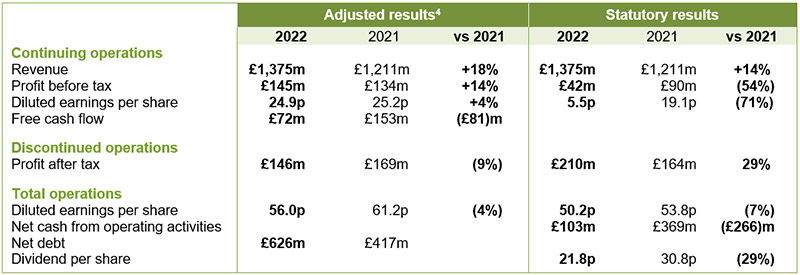

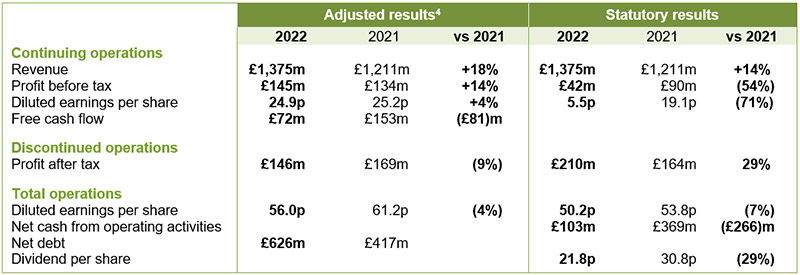

FINANCIAL SUMMARY3

NICK HAMPTON, CHIEF EXECUTIVE SAID:

“This has been a landmark year for the company. New Tate & Lyle delivered double-digit organic revenue growth across all regions and double-digit profit1 growth despite significant inflation across the supply chain. We also passed a major strategic milestone by refocusing the Group on our faster growing speciality food and beverage solutions business. To do this during a global pandemic, while serving our customers, accelerating innovation and living our purpose is a testament to the resilience, ambition and agility of all my colleagues.

Tate & Lyle is now a focused global leader in sweetening, mouthfeel and fortification, and very well-placed to benefit from growing consumer demand for healthier food and drink. Our strong balance sheet allows us to invest in organic and inorganic growth and the acquisition of Quantum Hi-Tech, a leading dietary fibre business in China, demonstrates our ability to further strengthen our portfolio and deliver on our growth agenda.

We entered the 2023 financial year with strong top-line momentum, innovation gathering pace and our productivity programme continuing to deliver benefits. Customer demand remains high and while the conflict in Ukraine has caused significant inflation in raw material, energy and logistics costs globally, we are taking actions to mitigate these pressures including supplementary pricing.

For the year ending 31 March 2023, we expect further progress with adjusted profit before tax in line with market expectations and revenue growth reflecting top-line momentum and the pricing through of higher input costs.

In the near term, our focus remains on continuity of supply, serving our customers and maintaining our financial strength and strategic progress. We have emerged from the pandemic a stronger, more ambitious business, and are excited about our future growth potential.”

HIGHLIGHTS5

Continuing operations (new Tate & Lyle) delivers strong revenue and profit growth

- Revenue +18% and adjusted profit before tax +14%

- Food & Beverage Solutions maintains positive top-line momentum:

- Volume +5% with particularly strong performance from Asia, Middle East, Africa and Latin America

- Revenue +19% with double-digit organic growth across all regions; 2ppts growth from acquisitions

- Profit6 +12% benefitting from positive mix; profit6 +7% including Primary Products Europe at £160m

- Robust performance from Sucralose:

- Volume +15% led by strong demand in beverages and the benefit of production optimisation

- Revenue +13% with higher volume partially offset by customer mix

- Profit6 +15% at £61m

- Adjusted diluted EPS +4% reflecting a significantly lower adjusted effective tax rate in the prior year

- Pro-forma adjusted diluted EPS7 at 40.0p assumes full-year effect of share consolidation

- Free cash flow of £72m (2021 – £153m) despite higher working capital requirements of £41m due to business separation planning

Significant acceleration in innovation and New Product revenue growth

- New Product revenue +35% reflecting strong demand for sugar reduction and clean label solutions

- New Products represent 14% of Food & Beverage Solutions revenue (16% ex-Primary Products Europe)

- Integration of tapioca and stevia businesses acquired in the 2021 financial year progressing well

Major strategic milestone passed to re-position Tate & Lyle as a growth-focused business

- Completed sale of controlling stake in Primary Products in the Americas creating Primient joint venture

- Tate & Lyle re-positioned as a focused global leader in sweetening, mouthfeel and fortification

Acquisition of Quantum Hi-Tech, a leading dietary fibre business in China

- Significantly strengthens fortification platform and solutions offering for customers

- Further expands business and presence in higher growth markets of China and Asia

Effective management of cost inflation in year through pricing, productivity and cost discipline

- Continuing operations: £100m inflation mitigated by pricing, productivity, cost discipline and volume/mix

- Six-year productivity programme to deliver US$150m benefits achieved two years ahead of schedule

Profit8 from total operations (Group) in-line with last year due to weaker discontinued operations

- Discontinued operations (Primient) volume in-line; adjusted profit after tax (9)% lower at £146m

- Sweeteners & Starches profit6 down (42)% as operational disruption outweighed firm demand

- Commodities profit2 52% higher benefiting from exceptionally strong market conditions

- Statutory profit after tax (7)% lower at £236m

- Exceptional costs of £96m partially offset by £83m benefit from held for sale accounting adjustments

- Adjusted diluted EPS (4)% lower at 56.0p; profit before tax in line with prior year and tax rate higher

- Net cash from operating activities of £103m, £(266)m lower mainly reflecting £(217)m higher working capital and £(60)m of exceptional cash costs (mainly Primient disposal related)

- Return on capital employed of 14.9%, down 240bps impacted by discontinued operations lower profits

- Net debt £209m higher at £626m at 31 March 2022; net debt to EBITDA ratio 1.3x pre-Primient closing

Strong balance sheet enables investment for growth and c.£500m special dividend paid in May

- Gross cash proceeds from sale of Primient business of approximately £1.1bn (including favourable working capital adjustment to recover working capital investment) subject to post-completion adjustments

- Returned c.£500m to shareholders in May 2022 by a special dividend and associated share consolidation

- Recommended final dividend of 12.8p reflects new earnings base and associated share consolidation

Good progress on sustainability programme and building a more agile and inclusive culture

- Scope 1 and 2 absolute GHG emissions 12% lower9; new commitment to be carbon net zero by 2050

- Building agile, ambitious and diverse culture; 42% of top 500 managers in new Tate & Lyle are women

- New targets established to progress equity, diversity and inclusion over next 2, 5 and 10 years

1 Adjusted profit before tax for continuing operations

2 Scope 1 and 2 absolute greenhouse gas (GHG) emissions in total operations in two years from the baseline of year ended 31 December 2019

3 Continuing operations is Food & Beverage Solutions (including European Primary Products business and certain stranded costs); Sucralose; and Central costs. Discontinued operations is the disposed Primary Products business (now called Primient). Total operations are continuing and discontinued operations combined.

4 The adjusted results for the year ended 31 March 2022 exclude exceptional items, amortisation of acquired intangible assets, the tax on those adjustments and tax items that are themselves exceptional. The adjusted results of discontinued operations have also been adjusted to exclude the impact of IFRS 5 held for sale accounting. A reconciliation of statutory and adjusted information is included in Note 3 and Note 8 to the Financial Information. Growth percentages are calculated on unrounded numbers. Changes in adjusted performance metrics are in constant currency throughout this statement. 5 Adjusted metrics percentage changes are in constant currency

6 Adjusted operating profit

7 Pro-forma EPS calculation shown in Additional Information at the end of this statement

8 Adjusted profit before tax

9 Reduction against baseline of year ended 31 December 2019; total operations

For more information contact Tate & Lyle PLC:

Christopher Marsh, VP Investor Relations

Tel: Mobile: +44 (0) 7796 192 688

Nick Hasell, FTI Consulting (Media)

Tel: Mobile: +44 (0) 7825 523 383