Key headlines1

- Power of the CP Kelco combination and leading formulation expertise driving strong customer engagement

Value of cross-selling pipeline more than doubled in Q2 driven by highly compelling customer offering

Structural trends towards healthier, more nutritious food reinforces growth opportunity of combined business

- Challenging economic environment with slowdown in market demand impacting current performance

Group revenue2 (3)% due to softer market demand as H1 progressed, notably in North America

Group adjusted EBITDA2 (6)% from top-line softness, growth investments and H2 weighting of cost synergies

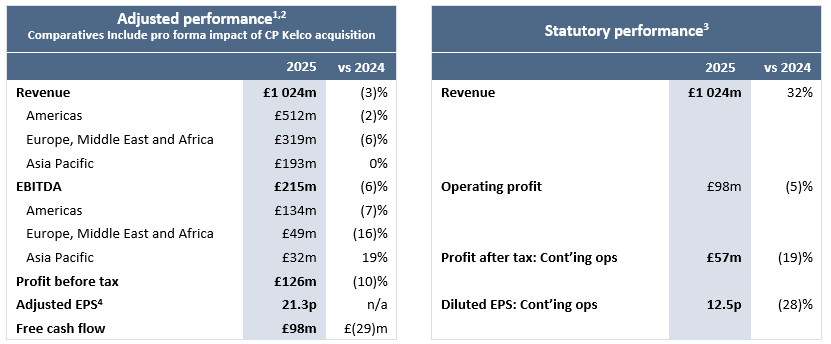

Financial summary

Nick Hampton, Chief Executive, Tate & Lyle said:

“Over the last six months we have made strong progress driving the benefits of the CP Kelco combination and setting the business up for future growth. Customer engagement is high, we are tracking ahead of our planned revenue and cost synergies, and the fundamental growth drivers of our business remain strong.

Despite this encouraging progress, performance in the first six months of the year has been disappointing, impacted by softer than expected market demand, notably in North America. As a result, we are accelerating a series of targeted actions to drive top-line growth and improve performance.

With our growing pipeline of new business opportunities, the power of the combination is clear. Our leading positions across sweetening, mouthfeel and fortification provide a unique platform to provide our customers with the solutions they need to meet growing consumer demand for healthier, more nutritious and sustainable food and drink. Our focus is on execution, delivering for our customers and growth.”

Outlook

Our outlook for the full 2026 financial year is unchanged from our pre-close statement on 1 October 2025. For the year ending 31 March 2026, in constant currency and compared to pro forma comparatives, we continue to expect revenue and EBITDA to decline by low-single digit percent compared to the prior year.

Financial highlights

Overview

Group revenue5 (3)% reflecting softer market demand

Group adjusted EBITDA5 (6)%

Adjusted EBITDA margin5 (80)bps lower at 21.0%

Adjusted profit before tax5 (10)% lower at £126m

Statutory diluted EPS6 (cont. ops) at 12.5p, 4.9p lower

Continuing cost discipline and operational efficiency drives first half productivity benefits of US$21m

5-Year productivity savings target to 31 March 2028 increased by US$50m to US$200m

Return on capital employed7 decreased to 8.2%.

Strong balance sheet

Free cash flow6,7 of £98m, £29m lower due to higher inventory; cash conversion of 71%

Net debt7 £952m at 30 September 2025, down £9m from 31 March 2025

Net debt to EBITDA leverage7 at 2.3 times

Interim dividend 0.2p higher to 6.6p per share.

Synergies delivery on track, now expect to exceed cost synergy target

Run-rate cost synergies of US$30m delivered at 30 September 2025

Now expect to exceed our target of US$50m run-rate cost synergies by end of the 2027 financial year

Targeting revenue synergies of up to US$70m by end of 2029 financial year.

Results presentation and webcast

A presentation to analysts of the results for the six months to 30 September 2025 will be hosted by Chief Executive, Nick Hampton, and Chief Financial Officer, Sarah Kuijlaars, at 10.00 hrs (GMT) on Thursday 6 November 2025. This presentation will be broadcast live on our website on a view-only basis here.

Pre-registered analysts and buy-side investors will be able to ask questions remotely during the Q&A session via a separate private link. Sell-side analysts will be automatically pre-registered. To pre-register, please contact Lucy Huang at [email protected].

A webcast replay of the presentation will be available shortly after the end of the live broadcast on the link above.

For more information contact Tate & Lyle PLC:

Christopher Marsh, VP Investor Relations

Tel: Mobile: +44 (0) 7796 192 688

Nick Hasell, FTI Consulting (Media)

Tel: Mobile: +44 (0) 7825 523 383

Tel: Office: +44 (0) 203 727 1340

[email protected]

1. Revenue growth, adjusted EBITDA and adjusted EBITDA margin, adjusted earnings per share, free cash flow, return on capital employed, net debt and net debt to EBITDA are non-GAAP measures (see pages 11 to 14). Changes in adjusted performance metrics are in constant currency and for continuing operations.

2. Comparative financial information is pro forma information, presented as if CP Kelco was acquired on 1 April 2024.

3. Statutory performance metrics changes are in reported currency.

4. Pro forma adjusted EPS for the comparative period has not been calculated as it was not possible to reliably estimate the pro forma effective tax.

5. Comparative financial information is pro forma information, presented as if CP Kelco was acquired on 1 April 2024. Changes in constant currency.

6. Comparative financial information is on an ‘as reported’ basis, i.e. CP Kelco is not included as the acquisition completed on 15 November 2024.

7. Non-GAAP measures (see pages 11 to 14 in the full statement)