Movements in adjusted results are shown in constant currency throughout this statement.

Key highlights

- Robust first half performance

- Food & Beverage Solutions revenue and profit2 higher

- Sucralose softer demand, profit2 lower

- Primary Products profit2 steady, helped by strong Commodities

- Strong operational execution and cost discipline underpins financial performance

- Priorities to ‘Sharpen, Accelerate and Simplify’ continue to support business progress

- Texturant portfolio strengthened with agreement to acquire speciality tapioca food starch business

- Balance sheet remains strong with access to US$1.4 billion liquidity

- Purpose-driven response to Covid-19 keeping employees safe and customers served

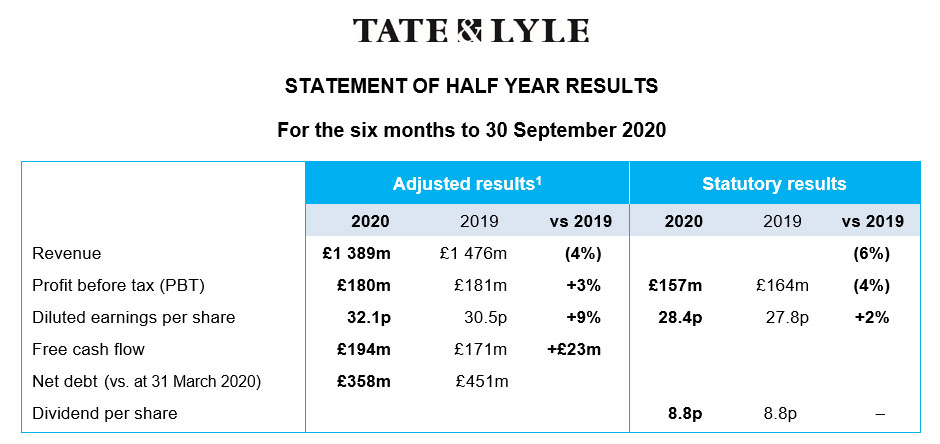

Financial highlights

- +9% increase in Food & Beverage Solutions profit2 at £98m; volume in-line and revenue +1% higher

- (12%) lower Sucralose profit2 at £25m

- Primary Products profit2 at £83m in line with the comparative period

- Sweeteners and Starches profit2 £(11)m lower; Commodities profit2 +£11m higher

- +21% increase in share of profit after tax of joint ventures including £4m foreign exchange benefit in Almex

- (4%) decrease in Group statutory profit before tax

- +3% increase in adjusted profit before tax

- +9% increase in adjusted diluted EPS

- Benefitting from joint venture foreign exchange and lower effective tax rate of 16.6% (2019: 20.9%)

- +£23m higher adjusted free cash flow at £194m

- Net debt to EBITDA ratio 0.7x

- Interim dividend maintained at 8.8p per share

Nick Hampton, Chief Executive, said:

"The first half of the year demonstrated the strength, resilience and agility of our business with Group profit higher, revenue growth in Food & Beverage Solutions and the interim dividend maintained.

This performance reflects the outstanding commitment of our people who have kept our operations running and our customers served through the pandemic. Our purpose of Improving Lives for Generations remains at the heart of our response to Covid-19, inspiring our people to look after their colleagues, families and local communities. I am very proud of, and humbled by, their resilience in the face of so many challenges.

Both business divisions performed well supported by excellent operational performance and rigorous cost discipline. Primary Products delivered steady earnings despite a significant reduction in out-of-home consumption in North America. Food & Beverage Solutions delivered revenue and profit growth as our technical capabilities in sweetening, texture and fibre fortification supported customer demand for products that are lower in sugar, calories and fat, and with added fibre.

We continue to make strategic progress. We signed an agreement to acquire a speciality tapioca food starch business in Thailand expanding our customer offering of plant-based, clean-label texturant solutions. Our new business and innovation pipelines remain healthy, New Products revenues are up 8% and we continue to find creative ways to use technology to support and connect with our customers.

While we are pleased with our progress in this challenging environment, considerable uncertainty remains. The duration and severity of the pandemic is unclear, out-of-home consumption remains below pre-pandemic levels and the annual sweetener contracting round is still to be completed. Given this uncertainty, we are not issuing guidance for the current year ending 31 March 2021. We will update stakeholders of our progress in our third quarter trading update on 28 January 2021.

In May we set out four priorities for the year – to look after our colleagues and communities, strengthen our relationships with customers, continue to progress our strategy and maintain our financial strength. We are making good progress against these priorities and they remain our near-term focus. We are also working to adapt to, and embrace, the new business environment and ways of working and are taking the necessary steps to invest in Tate & Lyle to ensure we emerge from this period an even stronger business. "

1 The adjusted results for the six months to 30 September 2020 have been adjusted to exclude exceptional items, amortisation of acquired intangible assets and the tax on those adjustments. A reconciliation of statutory and adjusted information is included in Note 2 to the Financial Information. Growth percentages are calculated on unrounded numbers. Changes in adjusted performance metrics are in constant currency.

2 Adjusted operating profit

For more information contact Tate & Lyle PLC:

Christopher Marsh, VP Investor Relations

Tel: +44 (0) 20 7257 2110 or Mobile: +44 (0) 7796 192 688

Nick Hasell, FTI Consulting (Media)

Tel: Mobile: +44 (0) 7825 523 383