Tate & Lyle PLC: Results for the Year Ended 31 March 2025

Issued: 22 May 2025

Strategic transformation positions business for growth

Tate & Lyle delivers 4% EBITDA growth and £190m free cash flow with CP Kelco integration on track

Tate & Lyle (LSE: TATE), a global leader in food and drink reformulation, today issues its full-year results for the 2025 financial year reporting robust volume and profit growth, strong cash generation and a newly enlarged business positioned at the centre of the future of food, focused on accelerating growth.

Nick Hampton, Chief Executive, Tate & Lyle said:

“Over the last seven years, we have been executing a major strategic transformation to make Tate & Lyle a growth-focused speciality food and beverage solutions business aligned to growing, long-term consumer trends for healthier, tastier and more sustainable food and drink. With the acquisition of CP Kelco in November 2024, this transformation is complete.

The combination with CP Kelco makes Tate & Lyle a leader in Mouthfeel, a critical driver of customer solutions, and further strengthens our Sweetening and Fortification platforms. Our broader portfolio and technical expertise also strengthen our customer solutions capabilities, and our ability to be the solutions partner of choice for customers. As an expert in reformulation, taking sugar, calories and fat out of food and adding fibre and protein, we are leaders in helping customers improve the nutritional balance of food. We are exactly where we want to be – right at the centre of the future of food.

As we start the new year, our focus is on delivering the benefits of the combination and accelerating top-line growth. Integration is progressing well and delivery of the synergies we previously announced is on-track. With significant opportunities ahead, we are confident in the growth potential of our business.”

Key headlines1

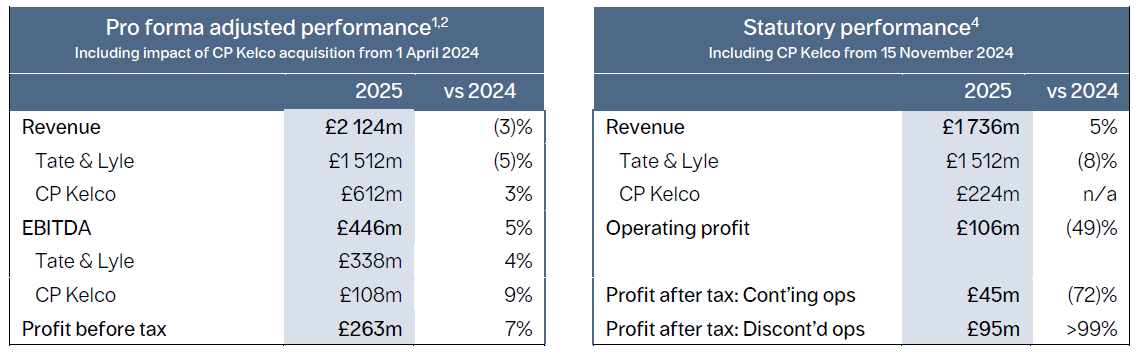

Robust performance (ex-CP Kelco): EBITDA +4% (EBITDA margin + 200bps) and revenue (5)%

CP Kelco ahead of our acquisition plan: EBITDA2 +9% (EBITDA margin +100bps)

Enlarged Tate & Lyle: EBITDA +5% on a pro forma basis2

Accelerating innovation: New Products revenue +9%3; Solutions new business wins by value at 21%

Productivity outperformance: US$50m of organic productivity benefits delivered, well ahead of our target

Higher EPS: adjusted EPS +4% at 50.3p; statutory diluted EPS 11.6p, (71)% due to exceptional costs

Excellent cash generation: Free cash flow of £190m (inc. CP Kelco), up £20m with cash conversion of 82%

Strong balance sheet: Net debt to EBITDA leverage of 2.2 times2 at 31 March 2025, better than expected

Enhanced shareholderreturns: £216m share buy-back completed; 3.7% increase in full-year dividend

Financial summary

Outlook

Given the significant benefits of the combination with CP Kelco, we expect the enlarged Tate & Lyle to deliver an attractive medium-term financial algorithm:

Our predominantly regional production model means we are well-placed to supply customers. However, tariffs and the associated uncertainty have increased costs for both us and our customers, mainly for products we supply between the US and China.

While we await clarification on tariffs, we currently expect, for the year ending 31 March 2026 in constant currency and compared to pro forma5 comparatives, to deliver revenue growth at, or slightly below, the bottom of our medium-term range, with EBITDA growth ahead of revenue balancing productivity, cost synergies and investment in future growth.

Performance highlights

Tate & Lyle (excluding CP Kelco)

Robust performance6

Group revenue (5)% reflecting the pass-through of input cost deflation

Group adjusted EBITDA growth +4% with adjusted EBITDA margin at 22.3%, +200bps

FBS revenue (7)%, volume +3% with deflation pass-through; adjusted EBITDA +2%, EBITDA margin 23.1%

Sucralose saw robust demand with revenue +16% and adjusted EBITDA +18%

Continuing cost discipline and operational efficiency drives in-year productivity benefits of US$50m.

Executing growth strategy6

New Product revenue +9% (like-for-like) with strong demand for fibres; +2% on reported basis

Solutions new business wins by value at 21% of pipeline, in line with the prior year

New partnerships for stevia from the Americas and for locally produced food starches in China and Brazil

Adjusted EBITDA margin expansion of more than 350bps in the last five financial years.

CP Kelco (pro forma for the 12 months ended 31 March 2025)

Momentum building with margin recovery underway5, 6

Revenue +3%, volume +8% from strong pectin performance, adjusted EBITDA +9%

Adjusted EBITDA margin at 17.6%, +100bps higher in the year, ahead of our acquisition plan

Confidence in continued phased margin recovery.

Enlarged Tate & Lyle (combined business)

Improved earnings

Pro forma5,6 revenue for 2025 financial year (3)% at £2.1bn, with pro forma adjusted EBITDA +5% at £446m

Including CP Kelco from the date of completion, adjusted EPS6 +4% at 50.3p

Organic return on capital employed 180bps higher; reported ROCE at 12.8%, down (460)bps.

Strong balance sheet

Free cash flow of £190m, £20m higher reflecting cash conversion of 82%

Net debt £961m; new long-term debt financing totalling US$900m in place

Net debt to EBITDA leverage at 2.2 times5, better than expected at time of CP Kelco acquisition.

Enhancing returns for shareholders

£216m share buyback programme completed, returning proceeds from Primient disposal to shareholders

Recommending final dividend of 13.4p per share; full-year dividend 19.8p per share, 3.7% higher.

Integration and synergies delivery on track

Run-rate cost synergies of more than US$25m expected in 2026 financial year

Confident in delivery of total US$50m run-rate cost synergies by end of 2027 financial year

Targeting revenue synergies of up to 10% of CP Kelco’s revenue by end of 2029 financial year.

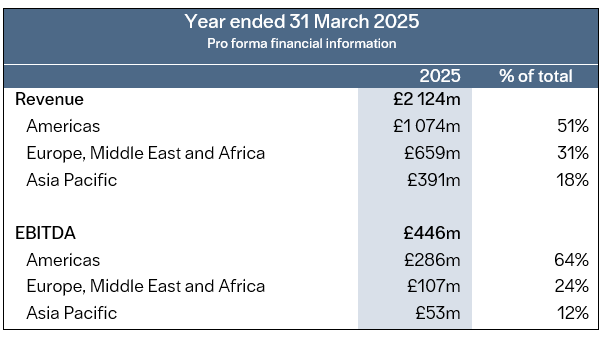

New Reporting Framework

From 1 April 2025, we have been operating as one combined business under a new regional framework of three operating segments – Americas; Europe, Middle East and Africa; and Asia Pacific.

Set out below is pro forma financial information for the 2025 financial year under the new framework.

Capital Markets events

As previously announced, we will be hosting a Capital Markets event for investors and analysts on Tuesday,

1 July 2025 in London. Presentations will include:

The CP Kelco business and the power of the combination with Tate & Lyle

How our expanded Mouthfeel capabilities is a key driver of customer solutions

The growth opportunity for our solutions from key societal trends

How our expanded scientific and innovation capabilities are placing us at the centre of the future of food.

This will be followed by a site visit to our pectin facility and labs in Lille Skensved, near Copenhagen, Denmark on Thursday 3 July 2025. This visit will include an overview of the scientific and production process for pectin and carrageenan, a plant tour, and an R&D demonstration and prototype tasting experience.

To register your interest for either or both days, please contact Lucy Huang at [email protected]. The event on 1 July 2025 will be webcast live.

Results presentation and webcast

A presentation of the results for the 2025 financial year to analysts will be hosted by Chief Executive, Nick Hampton, and Chief Financial Officer, Sarah Kuijlaars, at 10.00 hrs (BST) on Thursday 22 May 2025. This presentation will be broadcast live on our website on a view-only basis here.

Pre-registered analysts and buy-side investors will be able to ask questions remotely during the Q&A session via a separate private link. Sell-side analysts will be automatically pre-registered. To pre-register, please contact Lucy Huang at [email protected].

A webcast replay of the presentation will be available shortly after the end of the live broadcast on the link above.

For more information contact Tate & Lyle PLC:

Christopher Marsh, VP Investor Relations

Tel: Mobile: +44 (0) 7796 192 688

Nick Hasell, FTI Consulting (Media)

Tel: Mobile: +44 (0) 7825 523 383

Tel: Office: +44 (0) 203 727 1340

[email protected]

Revenue growth, adjusted EBITDA and adjusted EBITDA margin, adjusted earnings per share, free cash flow, return on capital employed, net debt and net debt to EBITDA are non-GAAP measures (see pages 12 to 15). Changes in adjusted performance metrics are in constant currency and for continuing operations.

Pro forma financial information is presented as if CP Kelco was acquired on 1 April 2024, with comparative information as if it was acquired on 1 April 2023.

New Products revenue on a like-for-like basis (i.e. no products removed from disclosure due to age); revenue was up 2% on a reported basis.

Statutory performance metrics changes are in reported currency.

Pro forma financial information is presented as if CP Kelco was acquired on 1 April 2024, with comparative information as if it was acquired on 1 April 2023. For more information see the ‘Additional Information’.

Changes in constant currency.