Our new CFO, Dawn Allen, joined us in May 2022. Here, from our Annual Report 2022, she talks about the year, along with her first impressions and thoughts for the year ahead.

Joining Tate & Lyle was in many respects an easy decision – a company driven by an inspirational purpose; a company that’s just completed a bold and ambitious transformation; a company that, in the context of all the challenges facing businesses today, has delivered a strong set of financial results. All three speak to strength of the management team and the growth potential of the business and I am delighted to have the opportunity to contribute my expertise to Tate & Lyle as it enters a new chapter in its history.

I’m delighted to have joined an exceptional team, and look forward to contributing my expertise to helping Tate & Lyle deliver our purpose-led growth strategy.

A ROBUST PERFORMANCE IN A CHALLENGING YEAR

Having only recently joined the business, and therefore having had no hand in the results I discuss in this introduction, I’d like to pay tribute to the whole Tate & Lyle team – and I include those now part of Primient – for their tremendous work in delivering these results. In the context of two years of a global pandemic, it’s certainly been a strong financial performance. It is especially noteworthy given that, in parallel, the team was also working to separate Tate & Lyle and Primient into two standalone businesses. They did this exceptionally well, with the finance team, particularly our shared services team in Łód´z, Poland, supporting the complex task of separating our systems.

The most pleasing aspect of this year’s results is that new Tate & Lyle – our continuing operations – performed so well. Revenue grew by 18%; adjusted profit before tax by 14%; and adjusted diluted earnings per share by 4% (all in constant currency). Within that, our Food & Beverage Solutions business grew volume by 5% and revenue by 19%, while Sucralose grew volume by 15% and revenue by 13%. That is impressive growth and shows the future potential of the business.

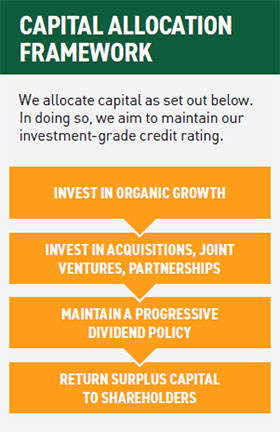

A STRONG BALANCE SHEET TO INVEST FOR GROWTH

However, the results were not without their challenges. Free cash flow from continuing operations was lower at £72 million, due in part to rising inflation later in the year, but also to decisions we took to reserve good service to customers ahead of closing the Primient transaction. Nonetheless, the transaction has left Tate & Lyle with a very strong balance sheet which gives us the ability to invest behind our growth strategy.

We have already begun to do this through the agreement to acquire Quantum Hi-Tech in China. We have a US$800 million undrawn credit facility; proven access to debt capital markets; and a cash generative business, all of which is a great position for a new CFO to be in.

That said, there are plenty of challenges ahead, not least rising cost inflation and operating in an increasingly uncertain world. It’s tough for many businesses at the moment, but Tate & Lyle has emerged from the pandemic in a position of strength and is well placed to navigate through these challenges and deliver on its growth agenda. I look forward to playing my part in this exciting future.

DAWN ALLEN, Chief Financial Officer

Discover more insights from our 2022 Annual Report here

There are more details in our latest Annual Report

Find out how we progressed in the last year and our future commitments in our latest annual report.