Market Insights – July 2020.

What counts as a sports nutrition product?

Sports nutrition products are those which are designed to improve athletic performance, support muscle growth and/or aid recovery after exercise. They come in various forms, such as snack bars, shakes or powders, and can be protein-based or have other core ingredients.

What does the market look like?

Sports nutrition is a huge market that has seen a lot of growth over recent years. In 2019 total global retail sales amounted to US$21.6 billion, up from US$15.1 billion in 2015 (Source: Euromonitor). The lion’s share of the market is in North America, but there are sizeable markets in all regions of the globe.

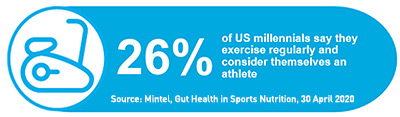

The sports nutrition market has benefited from the growing emphasis on staying fit and widespread gym culture, with frequent exercise becoming a lifestyle choice for many people. This may be partly attributable to social media and the visual culture, which has fed into the desire, particularly among young people, to look good and stay in shape. It is therefore perhaps not surprising that a lot of sports nutrition brands work with influencers to promote their products on social media platforms.

As a result, sports nutrition is now much more mainstream than before – sports bars and shakes are no longer the preserve of bodybuilders and the athletic elite.

How has Covid-19 affected the market?

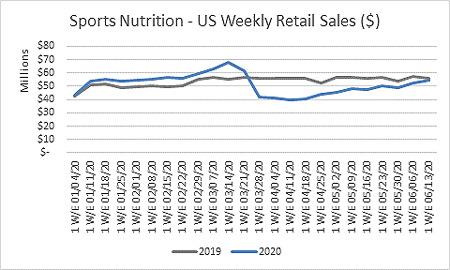

Covid-19 has inevitably affected the sports nutrition market. Following an initial spike in demand during widespread consumer stockpiling, demand fell sharply as many gyms and shops were closed, sports events suspended and more people stayed at home. Now that this is slowly reversing, demand is starting to recover and is almost back to last year’s levels (see chart below – source: US Nielsen Retail POS Data).

What do consumers want from the sports nutrition products of the future?

“Athlete wellness” is a trend increasingly coming to the fore, so we can expect to see more sports nutrition products that incorporate holistic wellness themes. This is a trend that has been reinforced by the Covid-19 pandemic as more people pay attention to health and diet, and their link with immunity.

The following are three key trends currently shaping sports nutrition.

Better-for-you products

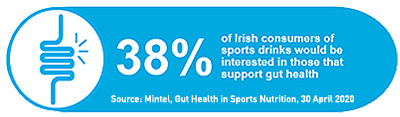

While consumers have shown a preference for some time for sports products that are low in sugar, an emerging trend is gut health. They are particularly interested in this because exercise, especially high-intensity exercise, has been found to lead to digestive problems for some. This could be down to the fact that, during exercise, blood is diverted to more metabolically active tissues (i.e. muscles, skin), meaning the gut receives less – leading to various types of gastric discomfort.

Sports nutrition products can help address this issue by incorporating easily digestible fibres and limiting the number of FODMAPs, which can be hard on digestion.

Personalisation

Athletes and frequent exercisers have different nutritional needs from the general population. This, combined with increasing awareness of the uniqueness of each person’s gut microbiome, is spurring demand for tailored sports nutrition.

More mass-market protein brands are making it possible for consumers to customise their protein powder according to their personal needs, including gut health.

Companies are also combining the more traditional features of sports nutrition with more niche benefits. For example, a pre-workout product supplemented with collagen for joint and skin health and probiotics for immunity.

Clean label

Consumers are increasingly reading labels and want to see ingredients they recognise. Sports nutrition brands are responding by including information on pack about, for example, where the ingredients originated from and sustainable farming practices, as well as seeking to include more natural and plant-based ingredients.

Which aspects of health and wellness are the food and beverage industry already catering for?

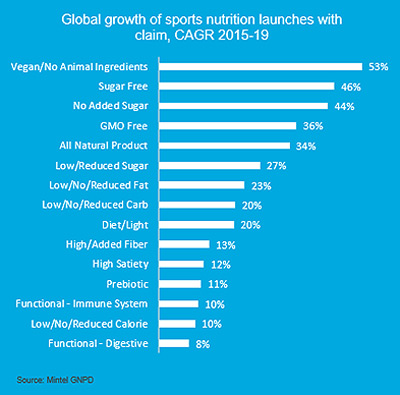

This core trend towards “athlete wellness” is already being reflected in recent product launches – the last five years has seen a significant growth in products featuring specific health or wellness claims.

These, and the three key consumer preferences described above, are likely to continue to influence the development of new products in the coming years.

How do consumer preferences translate into actual purchasing decisions?

In a consumer perception survey carried out earlier this year, we asked consumers across 14 countries how much specific ingredients affect their purchasing decisions for sports nutrition bars, protein powder and protein shakes.

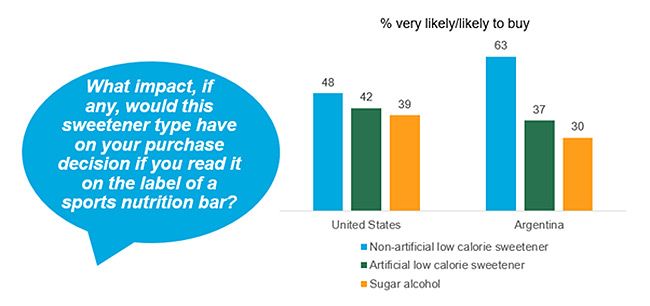

On sweeteners, we asked consumers what impact the presence of non-artificial low calorie sweeteners, artificial low calorie sweeteners and sugar alcohols in a sports nutrition product would have on their decision to buy. Almost across the board, consumers were more likely to buy products with non-artificial sweeteners than those containing the other types of sweeteners. In some countries, such as the US, the preference was only slight, whereas in others, such as Argentina, it was much more pronounced.

Fibre fortification is also viewed favourably, though again the extent of the positive impact on purchasing decisions varied across countries. For example, in Germany, 40% of consumers said the presence of fibre would make them likely or very likely to buy a protein shake, while in the Philippines, as many as 78% stated this.

Want to know more?

Here at Tate & Lyle, we not only have expertise in consumer decision-making and market developments, but also the science behind sports nutrition. Our broad portfolio of ingredients and solutions (including fibres, sweeteners and plant-based solutions), combined with our technical abilities, makes us well placed to help manufacturers of sports nutrition products meet the health and wellness demands of today’s consumers. Contact us to find out more.

Related articles:

Fuelling a sporty lifestyle: how do nutrition needs differ when you exercise a lot?

What is the FODMAP diet and how can food and drink manufacturers help cater for those following it?